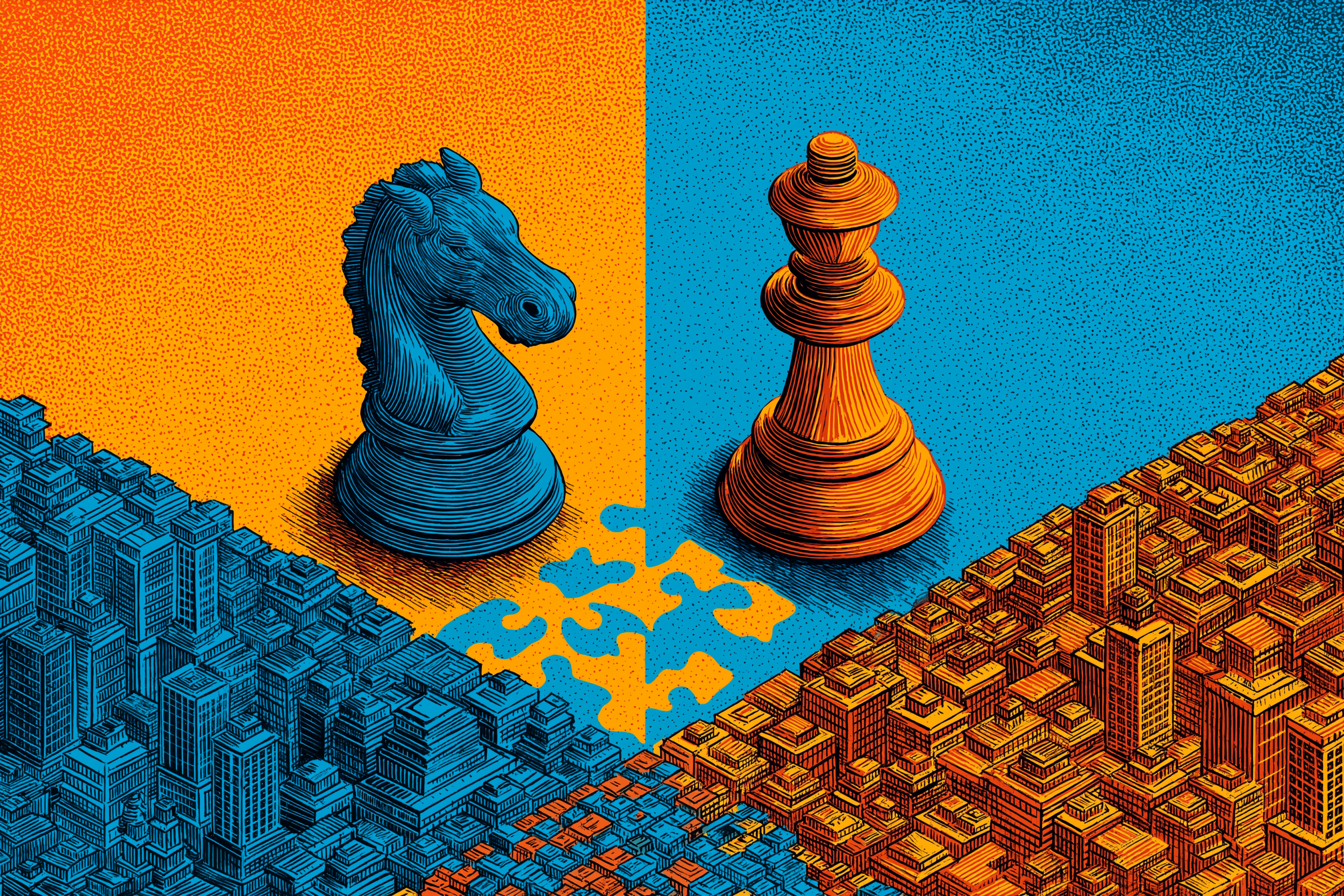

Post-Merger Integration Strategy: Designing for Value Creation

Strategy is the operating constitution of your deal. Define a one-page integration thesis, pick an integration model, publish decision rights, protect must-not-break areas, and stage the work so early wins build belief while big moves are taken with evidence.

Post-Merger Integration Success: Turning Deals Into Lasting Value

Most deals stumble in execution, not in strategy. This guide explains how to turn a signed transaction into sustained value: align leadership, design culture deliberately, set up an empowered IMO, protect revenue, and track benefits visibly - so your integration delivers results, not regrets.

Pre-Merger Strategy: Setting the Stage for Integration

Integration success starts before close. Learn how to pressure-test synergies with operators, pick the right integration model, plan Day-1 communications, map cultural risks, and prepare the artefacts—so your first 100 days run on rails instead of hope.

The Post-Merger Integration 100-Day Plan: Converting Thesis Into Traction

The first quarter sets trust. Use this 14-week sequence to execute Day-1 cleanly, defend revenue, publish roadmap or compliance bridges, stage TSA exits, and make benefits visible in finance—turning a strategy into bankable traction.

Life Sciences M&A: Capturing Synergies Without Losing Innovation

In pharma and biotech, compliance and science set the pace. This guide shows how to protect trials and batches, harmonise quality and PV, run MS&T tech-transfer sprints, and time regulatory variations—so innovation continues while efficiencies land.

Software Industry M&A: Capturing Synergies in a Fast-Moving Sector

Software integrations win on clarity and cadence. See how to publish a credible Roadmap v1, keep engineers and customers confident, launch focused cross-sell plays, avoid billing/entitlement mishaps, and decide consolidation with evidence - not faith.

Fractional Leadership Roles in M&A Integration: Bandwidth, Expertise, and Speed When It Matters Most

Deals strain leadership bandwidth. Learn how fractional CFO/COO/CTO/CHRO roles stabilise execution, own outcomes in the IMO, accelerate early wins, and transfer playbooks—so your team scales without sacrificing control or speed.

M&A Integration Services: When and Why to Seek External Support (and How to Get ROI)

External operators can be a force multiplier. Learn engagement models, decision rights, cadence, and benefit-tracking disciplines that keep partners accountable—and ensure knowledge is transferred so the business runs stronger after they exit.

Carve-Outs & TSAs: Exiting Cleanly and On Time

Separation is a race against TSA burn. Learn how to design TSAs with clear exit criteria, stand up identity, email, finance and payroll quickly, stage billing migrations, and govern risk—so you achieve operational autonomy on time and without customer shock.